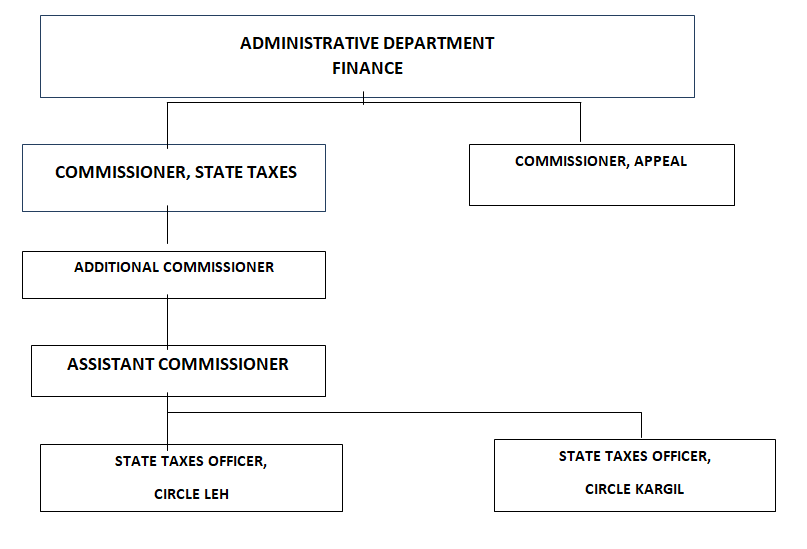

Brief information of the department:

State Taxes Department is headed by Commissioner, State Taxes and comes under Secretary of Finance. There are only two offices in each District headed by State Taxes Officer, Circle Leh/Kargil.

Vision: –

To build an atmosphere that encourages and incentivises self compliance of Taxes Laws and mobilises revenue in an efficient manner .

Mission: –

To provide excellent services to the honest dealers in a fair, professional, convenient and courteous manner with just application of Statutes and use of latest Technological Tools.

State Taxes Department Union territory of Ladakh is a major contributor to the Tax Revenues. This department manages complete tax administration life-cycle of taxpayers under Goods & Services Tax (GST)/ apart from managing other important acts Motor Spirit and Diesel Oil Act (MST).

The basic objective of the Goods and Services Tax is to bring all the persons liable to pay taxes in the stream of GST .Goods and Services Tax is a comprehensive tax to be levied on both goods and services.